Invented by Yuting Jia, Anand Ravindra Oka, Liang-Yu Chen, Yiqing Wang, Jayaram Naga Mrutyum NANDURI, Microsoft Technology Licensing LLC

Machine learning systems for taking control actions utilize algorithms that can learn from data and make predictions or take actions based on that information. These systems are designed to analyze large volumes of data, identify patterns, and make informed decisions without explicit programming. This ability to learn and adapt in real-time makes machine learning systems invaluable in industries such as manufacturing, logistics, finance, healthcare, and more.

One of the key drivers behind the growing market for machine learning systems is the increasing availability of big data. With the proliferation of connected devices and the internet of things (IoT), businesses now have access to vast amounts of data generated from various sources. Machine learning systems can leverage this data to gain insights, identify trends, and make predictions, enabling businesses to optimize their operations and improve overall performance.

In the manufacturing industry, for example, machine learning systems can analyze data from sensors embedded in machinery to detect anomalies and predict potential failures. By proactively identifying issues, businesses can schedule maintenance activities, minimize downtime, and reduce costs. Similarly, in the logistics industry, machine learning systems can optimize route planning, predict demand patterns, and enhance supply chain management, resulting in improved efficiency and customer satisfaction.

The finance industry is another sector where machine learning systems are gaining traction. These systems can analyze vast amounts of financial data, identify patterns, and make predictions about market trends or customer behavior. This enables financial institutions to make data-driven investment decisions, detect fraudulent activities, and personalize customer experiences.

The healthcare industry is also witnessing the benefits of machine learning systems. These systems can analyze patient data, medical records, and clinical research to identify patterns and make predictions about disease diagnosis, treatment plans, and patient outcomes. By leveraging machine learning, healthcare providers can improve patient care, optimize resource allocation, and enhance overall operational efficiency.

As the demand for machine learning systems continues to grow, so does the market. According to a report by MarketsandMarkets, the global machine learning market is expected to reach $96.7 billion by 2025, growing at a CAGR of 43.8% from 2020 to 2025. This growth is driven by factors such as increasing adoption of cloud-based technologies, advancements in artificial intelligence, and the need for efficient data analysis.

However, the market for machine learning systems for taking control actions also faces challenges. One of the key challenges is the availability of quality data. Machine learning systems heavily rely on data to learn and make accurate predictions. Therefore, businesses need to ensure they have access to clean, relevant, and diverse datasets to train their systems effectively.

Another challenge is the ethical considerations surrounding machine learning systems. As these systems become more autonomous and make decisions that impact human lives, it is crucial to ensure transparency, fairness, and accountability. Businesses must address issues such as bias in data, privacy concerns, and the potential for unintended consequences.

In conclusion, the market for machine learning systems for taking control actions is experiencing significant growth as businesses recognize the potential of this technology to optimize operations, improve decision-making, and enhance overall efficiency. With the increasing availability of big data and advancements in artificial intelligence, machine learning systems are poised to revolutionize industries such as manufacturing, logistics, finance, healthcare, and more. However, businesses must also address challenges such as data quality and ethical considerations to fully harness the potential of machine learning systems.

The Microsoft Technology Licensing LLC invention works as follows

A device within a data processing systems for training machine-learning models receives a transactions and forwards it on to at least one integrated control action model that uses outputs from one model as inputs into other models. These models are machine-learning models that have been jointly trained to take each control action from a number of control actions for the transaction in order to maximize an objective function, based on probabilities. Machine learning models also include a model of risk that generates information on risk for a control action to determine whether or not the transaction should be processed. The device receives risk prediction data from the model and executes a first control action at least based on that information.

Background for Machine Learning System for Taking Control Actions

The present disclosure is a general description of machine-learning-based control systems and, more specifically, an integrated machine learning system that provides control actions.

Machine-learning-based systems can be used to improve various technologies, but they are usually implemented independently. Machine learning models can be implemented in systems that are controlled by control actions. A payment/transaction system is one example of a technical system. Generally, in the chain of events that happen during a purchase authentication/authorization and the corresponding back office flow, there may be several ?control actions? The system will take a number of actions to determine whether or not to process a transaction. “Taking too restrictive control measures or loosing restrictions can result in an inefficient system and/or allow for some fraudulent transactions.

Generally, transaction processing systems can receive and process large numbers of transactions. For example, thousands or even millions per hour, day, etc. In the event that a machine-learning infrastructure is not efficient, it will require a lot of computing resources, such as processing and communication resources, to support te transaction processing system. It may even not be possible to respond timely in cases of resource shortage. If the transaction system makes sub-optimal decisions that lead to rejections or other adverse decisions for legitimate transactions or allows fraudulent transactions which are later identified as fraudulent, then the need to process and/or take additional control actions on these transactions will be a burden on the system and network and consume valuable computing resources, bandwidth, etc.

It is therefore necessary to develop more efficient methods and systems for configuring control actions.

The following provides a summary of a few aspects to give a general understanding of these aspects. This summary does not provide a comprehensive overview of all aspects. It is not intended to identify the key elements or define the scope of any aspect. This summary is intended to provide a brief overview of some aspects, and a precursor to the more detailed descriptions that will be presented later.

Embodiments” provide methods, devices, and computer-readable media for processing transactions with machine learning.

The method includes receiving a transaction and forwarding it to at least a single integrated merchant control action model that uses outputs of one model as inputs to other models. The method involves receiving a merchant transaction and sending it to one of several integrated merchant control models. These models use the outputs from one model to input other models. The plurality integrated control action model are machine learning models that have been jointly trained to take each control action from a plurality control actions on the transactions in order to maximize an objective function, based on a likelihood of the plurality control actions matching the corresponding target control action taken on the transactions. At least one of the integrated control action model includes a risk-prediction model that outputs risk prediction information for an initial control action that indicates if or not to process the transaction. The method also includes receiving risk prediction data from the model and executing the first control actions based on that information.

In a second aspect, there is a method for a data processing device that includes at least a processor and at most one memory. The memory contains instructions which are executed by the processor in order to process transactions with machine learning. The method can include receiving a transaction and processing it by using at least one control model. The joint learned models includes at minimum a first and second learned models that are jointly taught for taking each of a plurality control actions on an at least training transaction in order to maximize the expected value of the objective function associated with this at least training transaction.

The device of another aspect is a data processing system that includes at the least one computer and at the least one memory that communicates with the processor. The memory contains instructions that are executed by the processor to process transactions. This includes: receiving a transfer; forwarding it to at the least one of at a plurality integrated control-action models that uses outputs from one model as inputs to the other models.

The joint learned model includes at least a first learned model and a second learnt model that are jointly trained for taking each control action of a plurality of control actions on at least one training transaction so as to maximize an expected value of an objective function associated with the at least one training transaction based on a probability that the plurality match corresponding target controls actions taken on the aforementioned training transaction using both models. The joint learned models includes at minimum a first and second learned models that are jointly taught for taking each of a number of control actions in at least 1 training transaction. This is done to maximize the expected value of the objective function associated with this at least training transaction.

The one or more aspects are those features that have been described in detail and specifically in the claims, and which serve to achieve the above and related purposes.” The drawings and description that follow illustrate certain features of one or more aspects. These features are only a few examples of how the principles of different aspects can be applied. This description is meant to cover all of these aspects and their equivalents.

The detailed description given below, in conjunction with the drawings attached, is meant to be a description for various configurations. It is not intended to represent the only configurations that can be used in order to implement the concepts described in this document. To help you understand various concepts, the detailed description contains specific details. It will be obvious to those who are skilled in the arts that these concepts can be used without these specifics. Some well-known components are shown as block diagrams to avoid confusing such concepts.

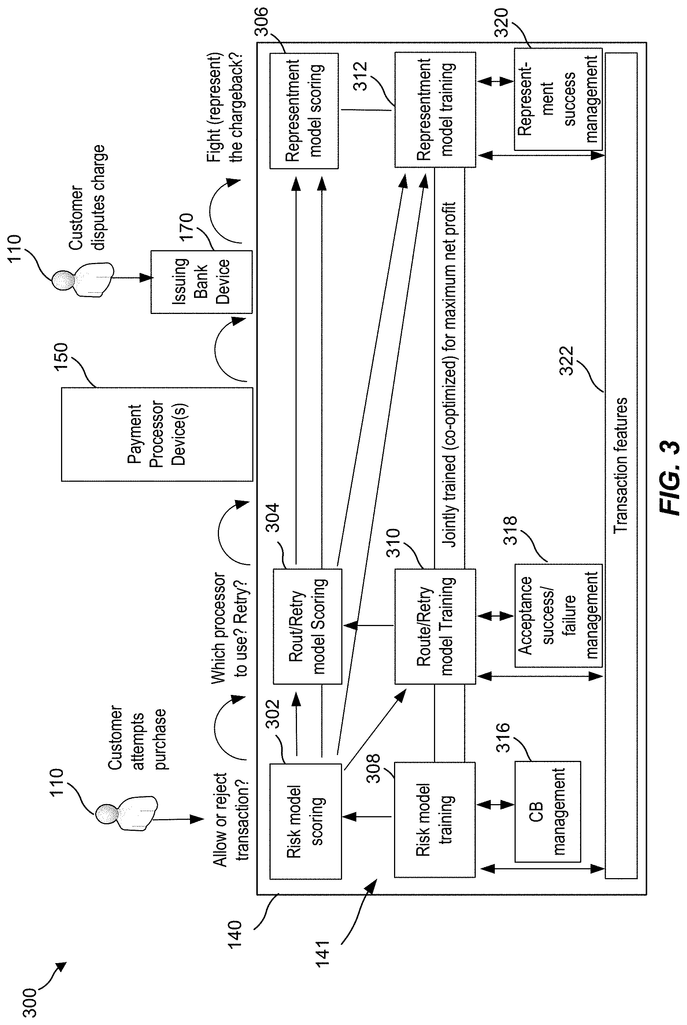

Aspects” of the disclosure present jointly-trained integrated machines learning models that are used to take control actions when processing transactions. In one aspect, integrated machine learning is jointly trained to take control actions on a particular transaction in order to maximize the objective function. This is based on the probability that the control actions match the target control actions. The integrated machine learning model is periodically retrained based on the historical data of control actions.

In one aspect of a payment system, a merchant control service is provided with a plurality integrated machine learning models. These models suggest to the merchant one or more merchant controls actions in response to an order transaction. In particular, the integrated machine learning models have been trained so that the suggested merchant controls actions will likely maximize the profits of the merchant associated with the purchase transaction. These merchant control actions can include, but not be limited to, actions related to determining the risk of a purchase, determining how to process the purchase, or determining whether a chargeback on a settled transaction should be disputed (re-presented).

In an aspect, in the chain of events that happen during payment authorization/authentication and back office flow, the control actions available to the merchant are jointly/simultaneously optimized (i.e., co-optimized) by cooperating machine learning models of the present payment system to maximize profits. In one aspect, the merchant’s control action service optimizes control actions jointly/jointly by leveraging the statistical and causal dependencies that exist between the success/failure rates of each control action in matching the corresponding target control measures that maximize profit of purchase transactions. In some aspects, machine learning models are trained using supervised, semi-supervised, or unsupervised learning. In one aspect, the cooperating model of the payment system optimizes a reward function that is associated with the expected profits from the purchase transaction. This reward function can take into account parameters like COGs (cost of goods sold), margins, re-presentation fees, chargeback penalties, etc.

The machine learning models jointly trained in the current aspects enable better control actions and make better decisions about transactions compared to known transaction processing systems. In some aspects, better control actions result in fewer overall control actions and reduce the computing resources required to process the transactions. By reducing the amount of communications required to process a transaction, for example, the current aspects can reduce network traffic, eliminate the need for redundant storage, increase the efficiency of the system, reduce storage costs and improve computer operations. The machine learning system of the present aspects, for example, may accurately predict the reaction of the banks to certain transactions and only send out requests which are more likely succeed. The present aspects also improve profits by increasing the success rate of good transactions (the settlement rate) and blocking bad ones.

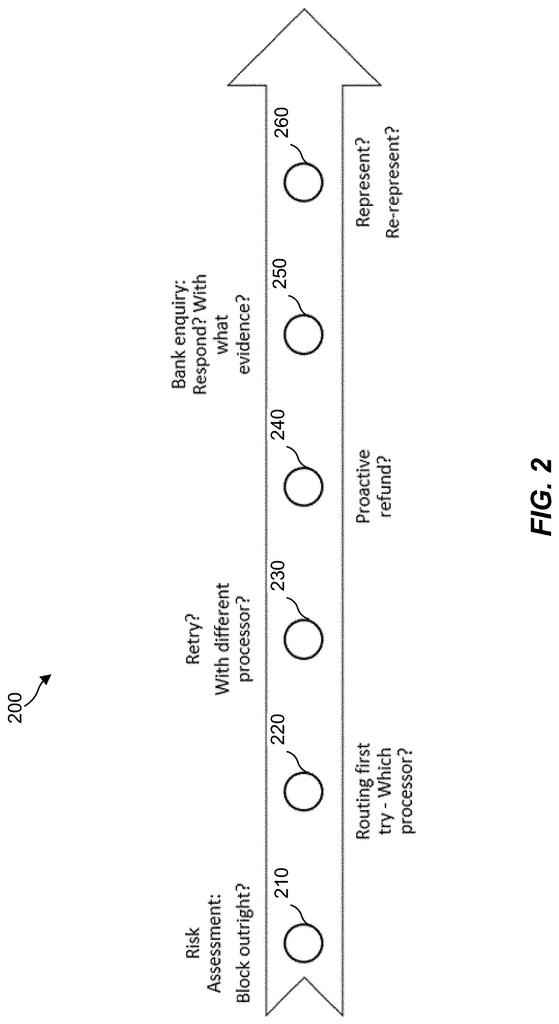

In one aspect, the payment systems provides a merchant with several control actions to help them make decisions about whether or how to complete a transaction. In one aspect, these decisions can include, for example, a decision on risk, a decision on route, a decision about retrying, a decision about re-presentation, or other decisions. The risk decision determines whether the transaction can proceed (e.g. whether to process a payment to purchase goods from the merchant). The risk decision can be produced by a model in the form of a score that can be compared with a threshold for identifying fraudulent transactions. or ?reject? The transaction can be’rejected’ or?accepted? The route decision will indicate which third-party payment processor to use (e.g. Adyen (First Data Corp. (FDC)), PayPal (PayPal), etc.). The purchase transaction should be processed by a routing model. The routing decision can be displayed by a model in the form of a score. This score is then compared with one or more thresholds to determine which processor to choose to process this transaction. Routing decisions are only made after the risk model has approved the transaction or a manual review. Retry decisions indicate whether the purchase transaction should be retried if it is rejected by the processor. The retry decision can be generated by a retry-model and used to determine whether or not to retry a transaction after the bank has declined it. The retry model may consider two factors: the possibility of being approved if a transaction is retried with another processor and the likelihood that a chargeback will be issued if retrying is successful. The re-presentation decision will indicate whether to dispute a chargeback issued by the bank in relation to the purchase transaction. The representation decision can be generated by a model that outputs the settled transactions when a chargeback is received. It immediately gives a decision, such as whether to dispute the chargeback or not, and provides representation evidence if a presentation occurs.

The dashed lines may indicate that the components or actions/operations are optional. The operations in the following methods may be described in a certain order or as being performed using an example component. However, depending on how the method is implemented, it is possible to change the order of the actions, and the components that perform the actions. In some examples, the actions, functions and/or components described below may be performed either by a processor specially programmed, by a processor that executes specially-programmed computer software, or by a combination of hardware and software components capable of performing these actions or functions.

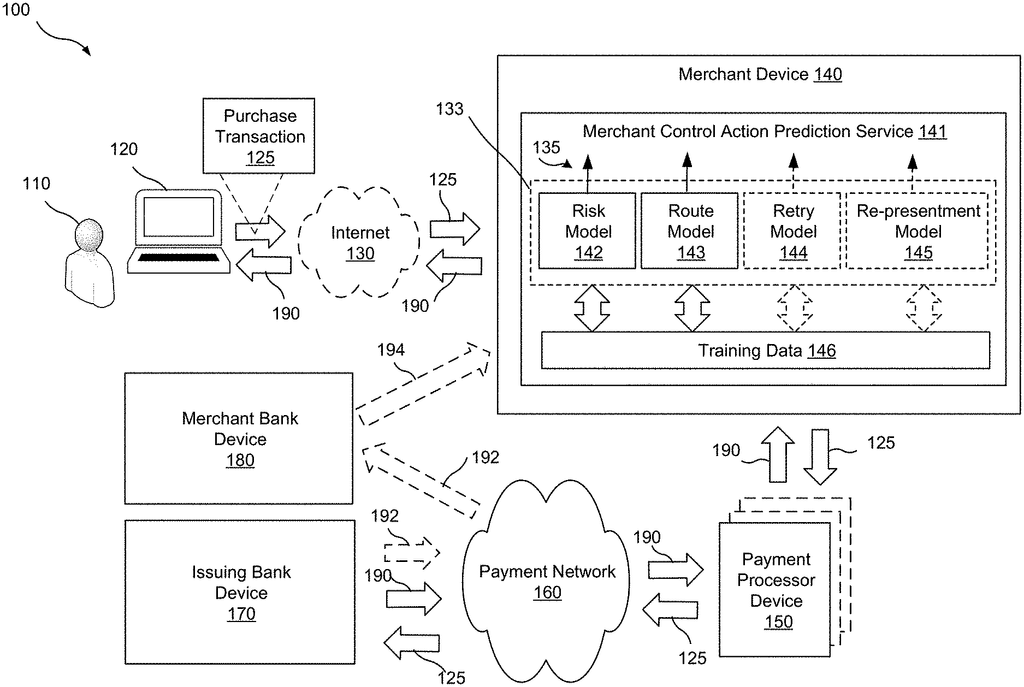

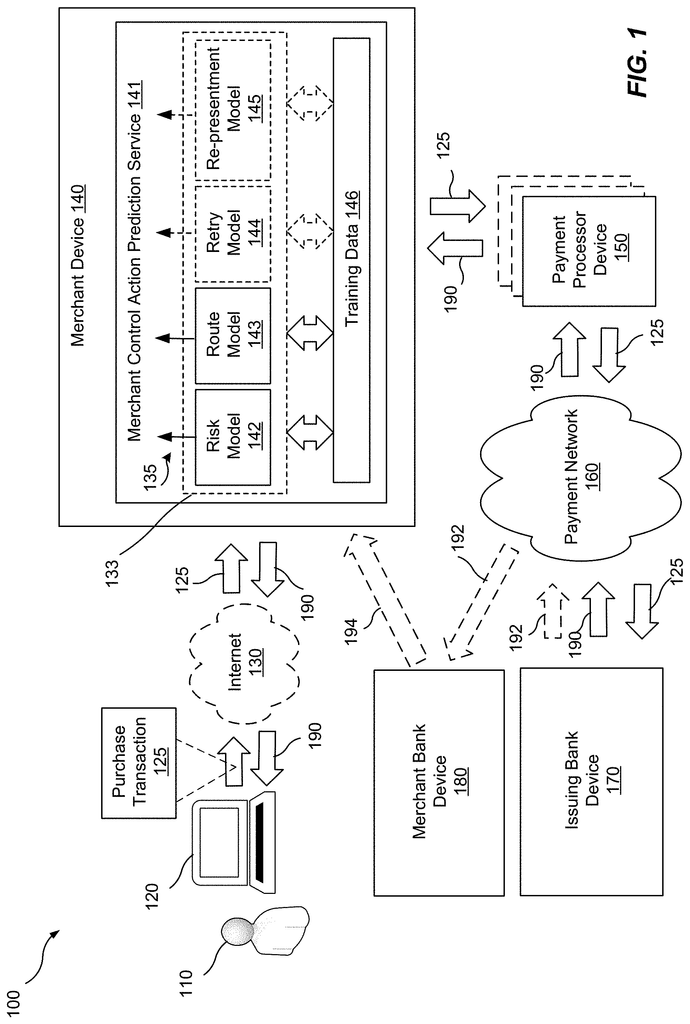

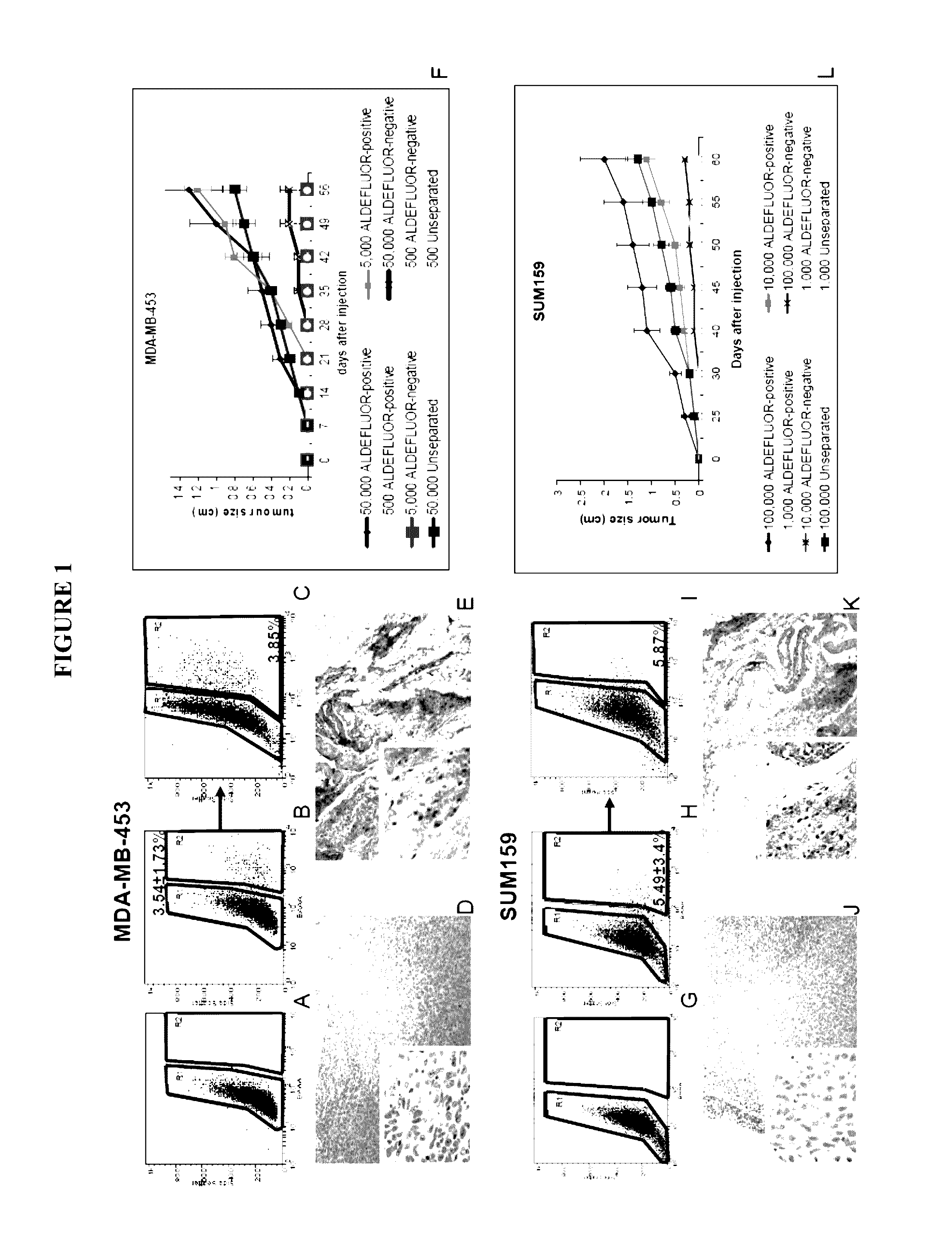

FIG. According to one aspect of the disclosure, FIG. 1 shows an example payment system having a machine-learning-based merchant control and action prediction service (141) that provides electronic payments to a retailer operating a merchant device for evaluating an online purchase transaction associated with orders placed by a customer 110. The merchant using merchant device 140 can be any entity configured to sell products or services, while the customer 110 can be any device or entity configured to pay for those products or services. When the customer initiates the purchase 125 using a web-browser on a computer 120, the merchant device receives corresponding information via the internet 130. The transaction information that is defined or included in the purchase transactions 125 can include but not be limited to payment instrument information, such as credit or debit card information, and customer information, including name, phone number and email address. ), merchant information, order or merchandise information, customer purchase history information, customer device fingerprinting information, customer device Internet Protocol (IP) address, etc. For simplicity, it is important to note that FIG. The example architecture in FIG. 1 shows an online purchase transaction (125), e.g. received by the retailer over the Internet 130, and the merchant control action predictions service 141, which is accessed locally by the merchant device. The merchant device 140 may, however, access the merchant control service 141 remotely, for example, via a wireless or wired communication network including the Internet 130.

In one aspect, the merchant device 140 accesses the merchant action prediction service 141 locally or remotely and uses the merchant control models 133. This allows the merchant device to produce prediction information 135 that indicates whether or how the transaction should proceed. It can also provide information and recommendations on what information is to be communicated to the relevant banks regarding the transaction. In an aspect, as mentioned above, the merchant action prediction service may be implemented local, e.g. by software, hardware and/or firmware that is executed by the merchant 140. In another aspect, the merchant action prediction service may be a remote cloud service that is accessible by the merchant device via the Internet 130. For example, this could be done through one or more APIs. The machine learning models that are implemented in the merchant action prediction service 141 can include all or part of the following: a risk model, a route, a retry, and/or an re-presentation model.

In one aspect, the merchant control service 141 uses training data 146 to train each machine-learning model. This data may be data that was previously produced by the same model or by another machine-learning model. In an aspect, the merchant control action prediction service 141 uses the training data 146 to jointly/simultaneously train all or a subset of the machine learning models. The joint/simultaneous-training, for example, means that inputs and/or the outputs of each model can be integrated. For example, the outputs from any one model could be used to input all other models or just a subset.

Click here to view the patent on Google Patents.