Problem & Solution

Is your intellectual property maximizing your startup's valuation? For early-stage companies, the single biggest asset is often the founder intellectual property. Yet, determining a fair pre-money valuation or structuring the founder equity split and IP ownership can be a complex and contentious roadblock to funding. Our Founder IP & Startup Valuation Tool simplifies this process. This essential tool provides a quantitative and defensible IP valuation for funding, giving you the clarity needed to impress investors and establish fair ownership from day one.

Benefit-Driven Value Proposition

Maximize Startup Valuation with a Data-Driven IP Strategy. Investors scrutinize IP because it dictates your defensibility and competitive moat. Our powerful startup valuation calculator goes beyond financial models—it incorporates a proprietary algorithm to accurately calculate startup IP value and its impact on your overall worth. Use this tool to model various scenarios, demonstrate the true value of your innovation to VCs, and secure the best terms for your next funding round. A higher, defensible valuation starts here.

Call to Action & Trust

Ready to calculate your pre-money valuation with IP and secure investor confidence? Don't walk into a pitch meeting without a clear, data-backed assessment of your most critical asset. Our secure, industry-tested Founder IP & Startup Valuation Tool is the definitive resource for serious entrepreneurs. In just a few minutes, you'll receive a comprehensive report detailing your IP contribution and potential valuation range. Click here to start your Founder IP Assessment for free and position your startup for maximum success.

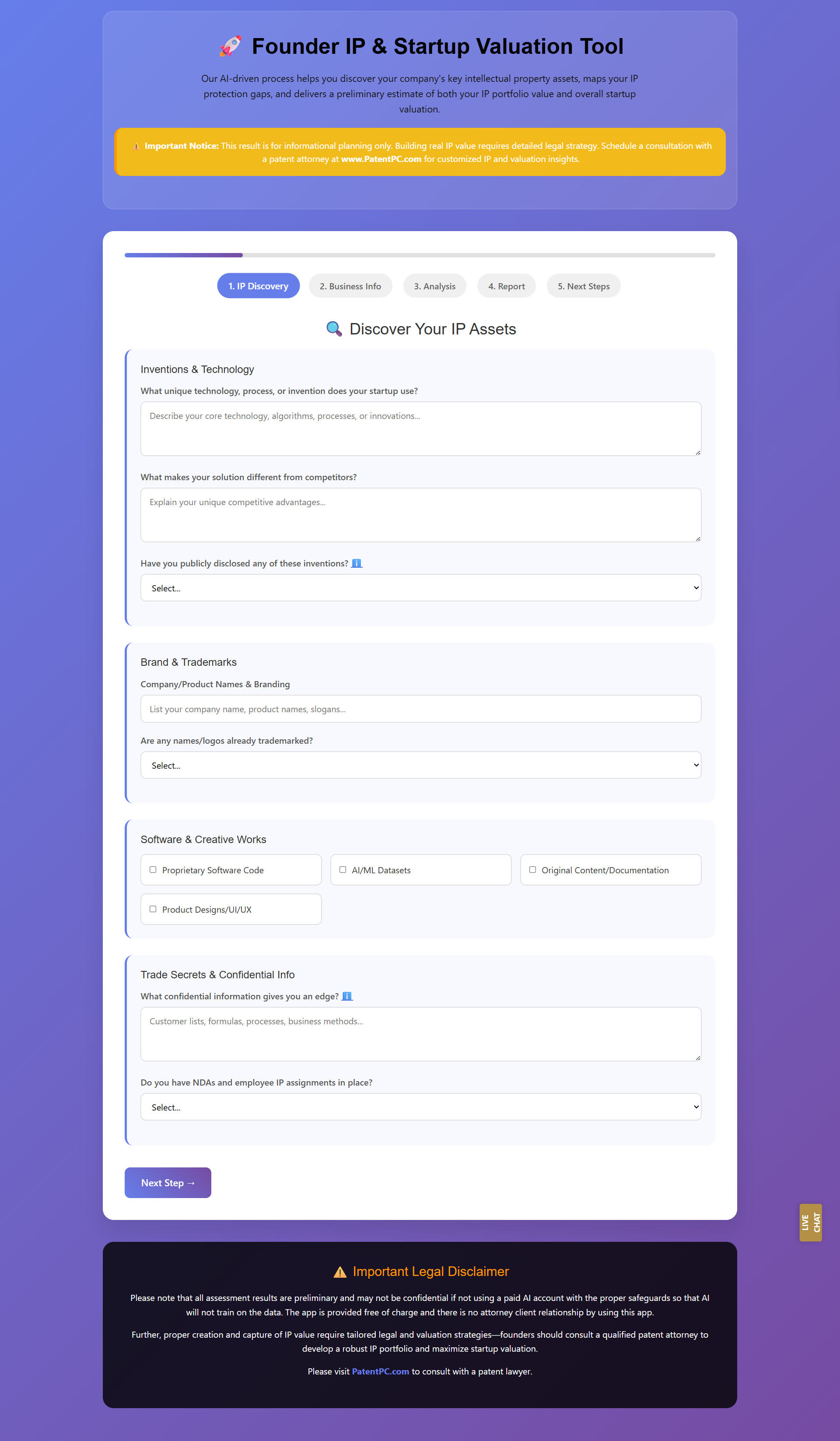

Founder IP & Startup Valuation Tool

Intelligent IP Discovery

Identifies and catalogs a startup’s key intellectual property assets.

Risk & Gap Assessment

Analyzes protection gaps to highlight areas needing stronger IP coverage.

Valuation Insights

Provides a preliminary estimate of both IP portfolio worth and overall startup valuation.