Invented by Cassie Boutelle, Lou Grilli, Troy Land, James Heystek, Wade D. Murray, Fidelity Information Services LLC

Blockchain technology, known for its decentralized and immutable nature, provides a distributed ledger that records transactions and ensures transparency and trust among participants. By incorporating cryptographic techniques, such as encryption and digital signatures, this system becomes even more secure and resistant to tampering or unauthorized access.

One of the key benefits of using cryptographic techniques in conjunction with a blockchain is the enhanced security it offers. Cryptography ensures that data and transactions are encrypted, making it extremely difficult for hackers or malicious actors to gain unauthorized access or manipulate the information. This is especially crucial when it comes to regulating the operation of units, as any tampering or unauthorized access can have severe consequences.

Moreover, cryptographic techniques also enable the use of digital signatures, which provide a way to verify the authenticity and integrity of data. Digital signatures ensure that the information has not been altered or tampered with since it was signed, adding an extra layer of trust and security to the system.

The market for these methods is witnessing significant growth due to the increasing demand for secure and transparent systems across various industries. For instance, in the Internet of Things (IoT) sector, where numerous devices are interconnected, the need for a secure and regulated operation is paramount. By using cryptographic techniques in conjunction with a blockchain, IoT devices can securely communicate and interact with each other, ensuring that only authorized actions are performed.

Similarly, in the financial sector, the use of cryptographic techniques in conjunction with a blockchain can revolutionize the way financial assets are regulated and traded. By creating a transparent and tamper-proof system, it becomes easier to track and verify the ownership and transfer of assets, reducing the risk of fraud or manipulation.

The market for these methods is also driven by the increasing adoption of blockchain technology across various industries. As more organizations recognize the potential of blockchain in enhancing security and transparency, the demand for methods that combine cryptographic techniques with blockchain is expected to surge.

However, challenges remain in terms of scalability and interoperability. Blockchain technology, while secure and transparent, still faces limitations in terms of processing speed and scalability. As the market for methods for regulating the operation of units grows, there will be a need for solutions that can handle a large number of transactions without compromising on security or performance.

Additionally, interoperability between different blockchain networks and cryptographic techniques is crucial for the widespread adoption of these methods. As organizations and industries adopt blockchain technology, they may have different requirements or preferences when it comes to cryptographic techniques. Ensuring interoperability and compatibility between different systems will be essential for the market’s growth and success.

In conclusion, the market for methods for regulating the operation of units by using cryptographic techniques in conjunction with a blockchain is witnessing rapid growth. The combination of blockchain technology and cryptographic techniques offers enhanced security, transparency, and trust, making it an ideal solution for various industries. As the demand for secure and regulated systems continues to rise, the market for these methods is expected to expand further, driving innovation and advancements in the field.

The Fidelity Information Services LLC invention works as follows

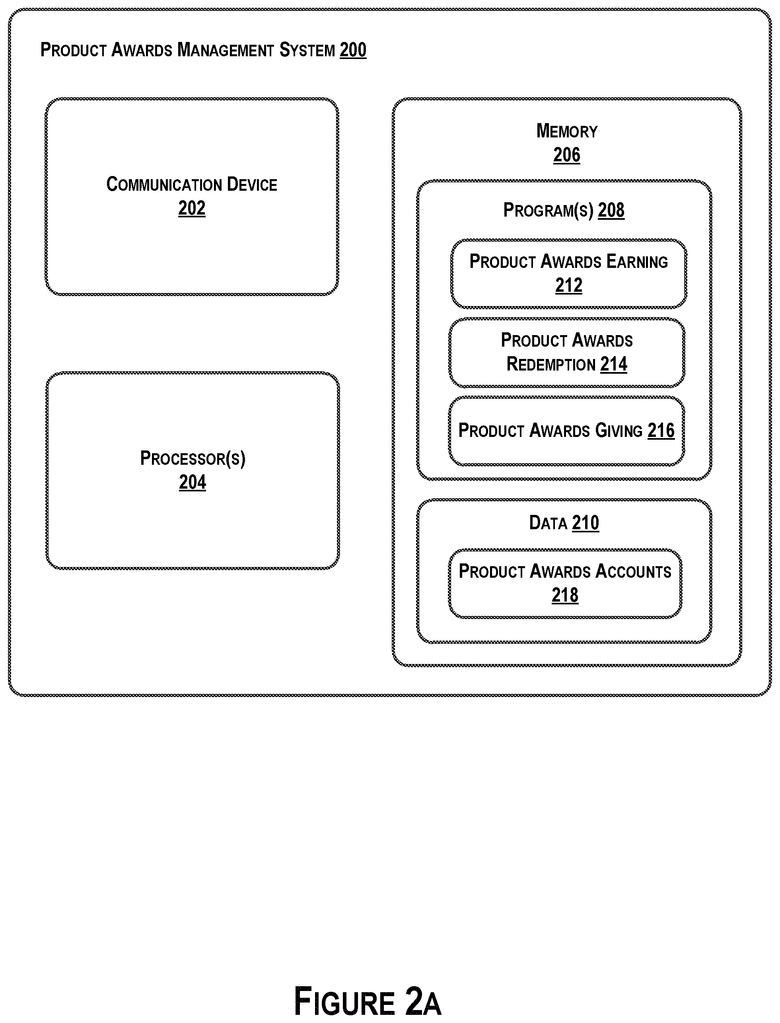

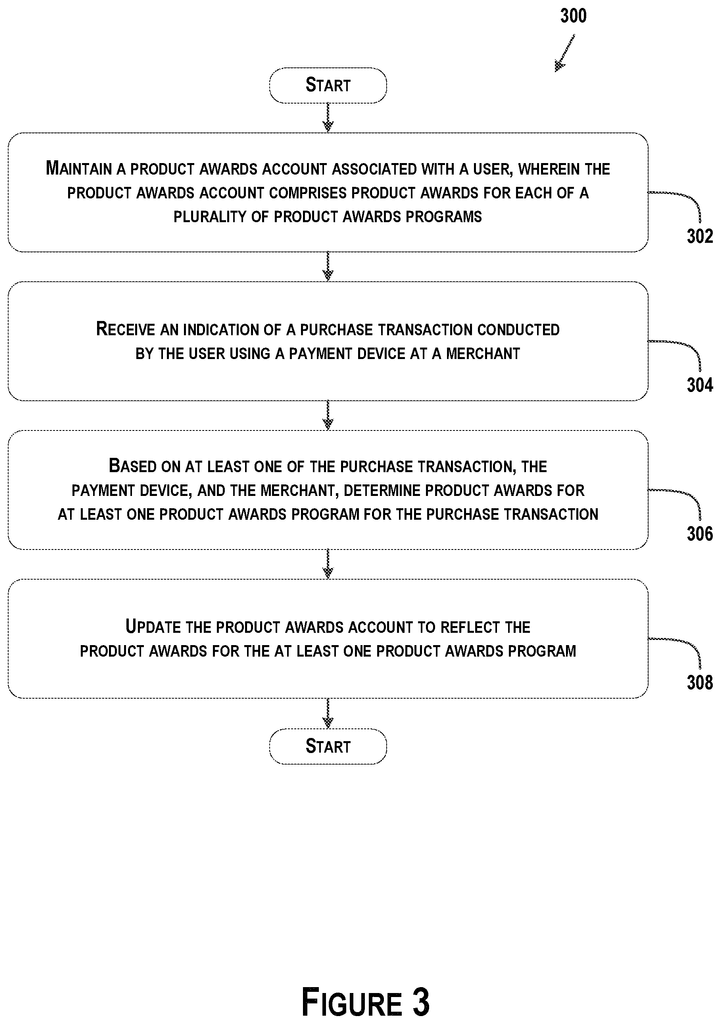

Methods for regulating the generation of units based on at least one cryptographic technique associated with a Blockchain are disclosed.” In some embodiments, the system comprises a communication device that can communicate with a computing unit executing an app and a processor that can execute instructions for performing operations. These operations include: receiving transaction information about a transaction. Based on the transaction determining product rewards for at least a product award program for the transactions. Using the blockchain, determining the real-time rate of conversion for the transaction.

Background for Methods for regulating the operation of units by using cryptographic techniques in conjunction with a Blockchain

Some merchants or financial service providers offer product award programs that allow users to earn product awards. As an example, a frequent flyer program may be offered by an airline. Users can earn “miles” through this program.

Product award programs are usually supported by a product rewards system. The product award system can support product awards provided by several merchants and financial services providers. The architecture of the product award system typically requires that each merchant and financial services provider access the system via a unique user interface. These interfaces can implement technology that is specific to the financial service provider or merchant. These interfaces could hinder the integration of the product award system.

The disclosed embodiments can include systems and method for regulating the generation of units based on at least one cryptographic technique associated with a Blockchain.

The operations may include maintaining an account associated with the computing device, wherein the account comprises product awards for each of a plurality of product award programs; receiving transaction information describing a transaction from a computing device through the application; based on this information, determining product awards for at least one program; using a blockchain to determine a real-time conversion rate for that particular transaction; converting those product awards to units based on that real-time conversion rate; updating to reflect these units in order to reflect the at least one The operations can include: maintaining an account for the computing device; the account includes product awards from a plurality product award programs; receiving transaction information for a transaction through the application; based upon the transaction information, determining the product awards for atleast one product award program for the particular transaction; using blockchain, determining the real-time rate for the specific transaction; based upon the real-time rate, converting product awards into units; updating account to reflect units for atleast one product award program; entering encrypted data associated the

The method of another embodiment includes: maintaining an account for a computing device; receiving transaction information from the computing device via the application; based upon the transaction information, determining the product award for at least a product awards program associated with the particular transaction; using the Blockchain, determining a conversion rate in real-time for the specific transaction; converting the product award to units based on this conversion rate; updating the account with the units for at least a product awards program and entering encrypted data into the blockchain. Some aspects of the disclosed embodiments include tangible computer-readable mediums that store software instruction that, when executed on one or multiple processors, is configured and capable of performing or executing the methods, operations and the like that are consistent with the disclosures. Aspects of the disclosed implementations can be performed by one, two, or three processors configured as special-purpose CPUs based on the software instructions programmed with logic that performs, when executed, operations consistent with disclosed embodiments.

It is understood that the general description above and the detailed description below are only exemplary and explanatory and do not restrict the disclosed embodiments as claimed.

A detailed description of the disclosed embodiments will be given, with examples illustrated in the accompanying drawings.

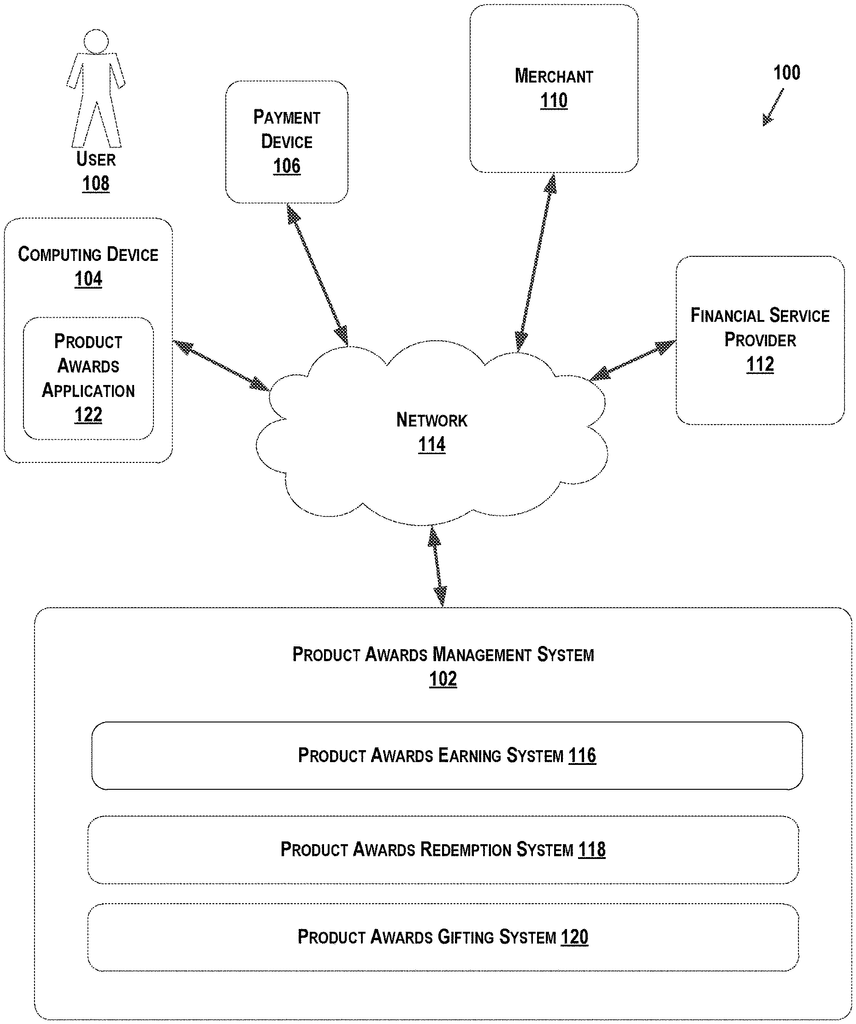

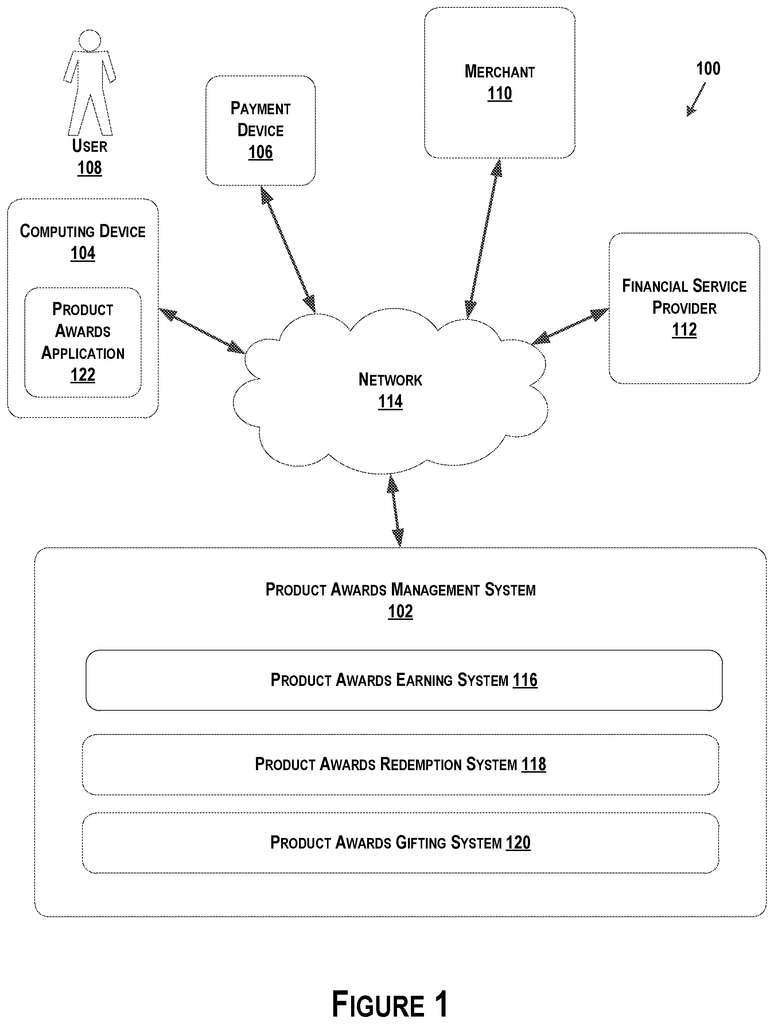

FIG. Block diagram 1 shows an exemplary system 100 for awarding products in accordance with the disclosed embodiments. System 100 can be configured to perform one or more processes for awarding products in accordance with disclosed embodiments.

As shown, the system 100 can include a product award management system 102 as well as a computing device and payment device 106 that are associated with a merchant 110 and financial service provider 112. All of these components may be connected by a communication network 114. Although only one product award management system 102 is shown, as well as a computing device 104 and payment device 106 for a merchant 110 and a financial service provider 112, it should be understood that the system 100 can include more than one. The components and the arrangement of components in system 100 can vary. System 100 can include additional components that assist or perform one or more processes in accordance with the disclosed embodiments.

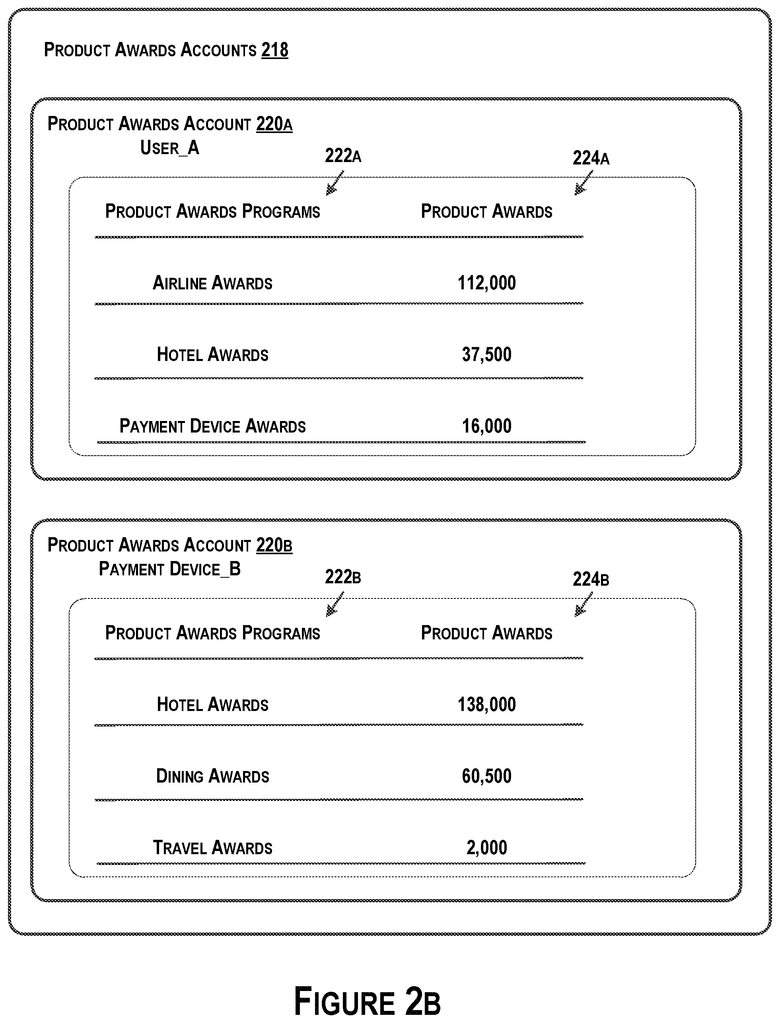

Product Awards Management System 102″ may be one of more computing devices that are configured to perform operations in accordance with maintaining a multitude of product award accounts, such as a product awards earnings system 116. A product award account can be any account that is associated with an entity offering a product rewards program, through which product awards are earned (e.g. collected, accumulated etc.). Based on transactions such as purchases. Any award, premium, coupon and/or any other item of value can be awarded as part of a transaction involving a product. A product can be any service, information, or good. There are other product awards that can be made. The product awards earning system may, for example, be configured to keep a product award account that is associated with the user 108, computing devices 104 and/or payment devices 106. For example, each product awards account could include product awards from a variety of product award programs. A product awards account that is associated with a user 108, computing devices 104 and/or payment devices 106, for example, may include product rewards from a program offered by merchant 110 or financial service provider 112. Other forms of product awards accounts or programs are also possible. The product awards earning system may also be configured to update the product awards account of user 108, computing devices 104 and/or payment devices 106 when product awards are received through transactions such as purchases. When user 108 makes a purchase at merchant 110, the product awards earning system may update an account of user 108, computing devices 104 and/or payment devices 106 in order to reflect product awards earned. The following description of product awards and accounts is further explained in conjunction with FIGS. “Figures 3, 4 and 5A-5B.

Alternatively or in addition, the product awards management system may be comprised of one or more computers configured to perform redemption operations through, for instance, a product award redemption system 118. Redemption can be defined as any transaction where product awards are exchanged with another item of value such as cash, coupons, or other product awards. User 108 can redeem product rewards in a product award account that is associated with the user, computing device, or payment device. Other forms of redemption are possible. The following sections will describe the redemption in relation to FIGS. 6, 7, and 8A-8D.” “Figures 6, 7 and 8A-8D

Still, alternatively, or additionally, the product awards management system may be one, or more, computing devices configured for operations consistent with gifting product awards, such as a product award gifting system 120. Gifting can be defined as any transaction where product awards or an item of value that product awards are exchanged for through product award redemption system 118 is transferred to another account. Through the product awards gifting 120 system, a user 108 can gift product rewards in a product award account that is associated with user(s) 108, computing devices 104 and/or payments devices 106, to another user (or computing device or payment device). Other forms of gifting are possible. The following sections will describe gifting in relation to FIGS. “Figures 9, 10, and 11A-11D.

While product award earning system (116), product award redemption system (118), and product award gifting system (122) are all shown as being included in the product awards system 102, it is possible that one or more of these functions may be performed in another entity. For example, an entity which has contracted with product awards system 102. While product awards system 102 has been shown to be a single entity in some embodiments, it may also be multiple entities. The functions of product award earning system, product award redemption system, and/or gifting system may then be divided among these entities. Product awards management system may also take on other forms.

Alternatively or additionally, the product awards management system may be configured to perform functions consistent with providing a Product Awards application 122 on computing device 104. When executed on computing device 104 the product awards application 122 allows user 108 interact with product award earning system 116 in order to create, view, or maintain a product account, as well as earn product rewards. Product awards application 122 can be an application which, when executed on computing device 104 allows user 108 interact with the product awards redemption system to redeem product rewards in a account for an item. Product awards application 122, on the other hand, may be an app that, when run at computing device 104 allows user 108 interact with product award gifting system to transfer product rewards in a account to another account, associated with a different user, computing device and/or payment device.

Computing devices 104″ may be one of more computing devices that are configured to perform the operations required for executing the product award application 122. Computing device 104 can be a desktop, mobile or combination of desktop and mobile computing devices, including a laptop, smartphone, tablet or any combination thereof. Computing device 104 can also be configured to become a wearable device, such as jewelry, smartglasses, or other devices that are suitable for wearing or carrying on the user’s body. “Other implementations that are consistent with the disclosed embodiments may also be possible.

Payment device” 106 is a financial service product that may be associated with the financial services account of the user 108. Financial service provider 112 may provide the financial services account, or another provider of financial services. Payment device 106 can be any device that is used to make transactions with a merchant such as merchant 110. Payment device 106 can be a financial card such as a debit card, credit card or loyalty card. Payment device 106 can also take on the form of a physical financial product such as a smartcard or key fob. Payment device 106 can also take on the form of digital financial products, such as digital wallets and/or payment applications. Payment device 106 can be included or integrated into computing device 104 in some embodiments. Payment device 106, for example, may be implemented as a payment app that is executable on computing device 104. Payment device 106 can also take on other forms.

Merchants 110 can be any type of entity offering items of value. This includes retailers, service providers, and any other entity that provides items of value to purchase. Merchant 110 can be, operate and/or be associated with any number of retail environments. This includes physical retail environments such as a merchant’s store, or online retail environments like a merchant’s webpage.

Merchants 110 may include or be one or more computing device configured to perform transactions such as purchases.” Merchant 110, for example, may be configured to take part in a transaction in which the user 108 purchases a value item from merchant 110 using a computing device 104 or 106.

Financial Service Provider 112″ can be any entity which provides, maintains or manages financial services. Financial service provider 112 could be, for example, a credit card company, bank or other financial service entity which generates, manages and/or maintains accounts. Financial service provider 112 can, for example, generate, provide and/or manage a financial services accounts associated with user 108. In some embodiments the computing device 104 or payment device 106 can also be linked to the financial services account.

Merchants 110 and/or Financial Service Provider 112 could be linked to one or more award programs. Product awards programs can be any program that allows product awards to be accumulated through transactions such as purchases. Merchant 110, for example, may be affiliated with a program that allows user 108 to accumulate product rewards based on the transactions performed by user 108. If merchant 110 is an airline, for example, merchant 110 could be associated with a frequent-flyer program. Another example is that financial service provider 112 could be linked to a program of product awards associated with payment device. User 108 can accumulate product rewards based on the transactions they make using payment device. If financial service provider is a financial institution, such as a bank or credit union, then financial service provider may be affiliated with a banking award program.

Product awards management system 102 may provide, manage, and/or maintain product awards programs for merchant 110 or financial service provider 112. Product awards earning system (116) at product award management system 102, for example, may maintain for user 108 a product rewards account that includes product credits for a program of product awards associated with merchant 110 or a program of product awards associated with financial services provider 112. Other product award programs are also possible.

Click here to view the patent on Google Patents.