Invented by Griffith; Hugh, McGuigan; Christopher, Ferrari; Valentina, Serpi; Michaela, Antunez; Carmen Jimenez, Nucana plc

**Unlocking a New Paradigm in Cancer Treatment: Cordycepin Prodrugs Targeting Cancer Stem Cells**

The relentless quest for safer, more effective cancer therapeutics has taken a promising leap forward with the invention of a novel class of chemical compounds: phosphoramidate derivatives of cordycepin (3′-deoxyadenosine). These compounds, described comprehensively in the patent family culminating in U.S. patent application Ser. No. 17/833,780 and its preceding filings, represent a cutting-edge approach to circumvent long-standing limitations in purine-based nucleoside chemotherapy, especially for leukemia, lymphoma, and a wide range of solid tumors.

**Restating the Invention**

At its core, this invention encompasses a series of cordycepin derivatives modified through phosphoramidate ProTide technology at the 2′ and/or 5′ positions of the ribose moiety. This innovation addresses a major pharmacological bottleneck: the rapid deamination of 3′-deoxyadenosine by adenosine deaminase (ADA), which has historically necessitated co-administration of ADA inhibitors—products noted for dangerous toxicity profiles, such as pentostatin.

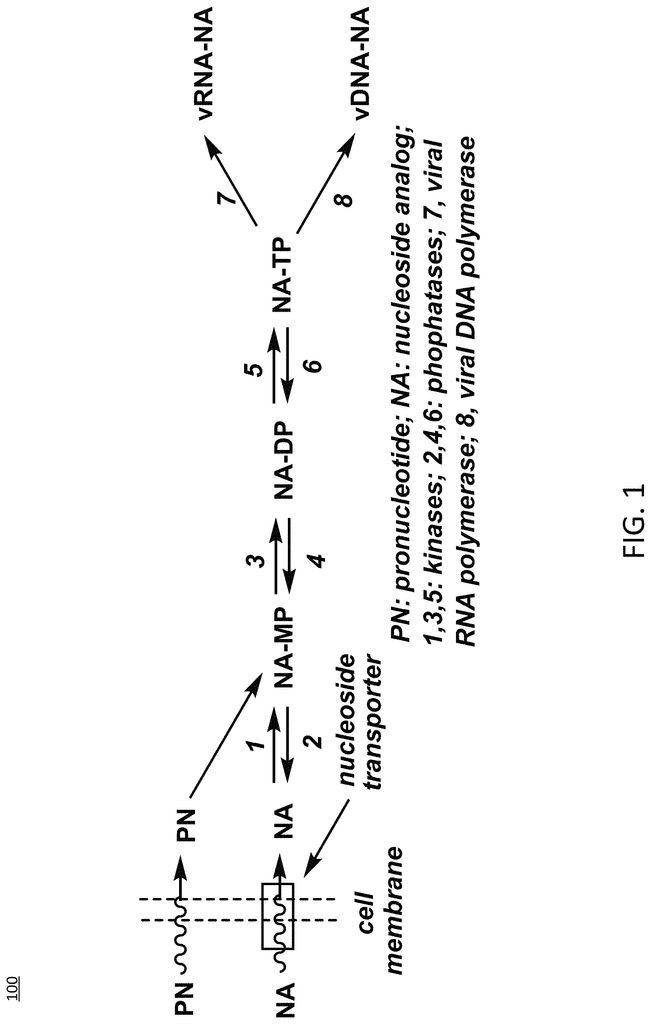

Here, the phosphoramidate moiety serves a dual role. First, it shields the nucleoside from enzymatic degradation, thereby enhancing its stability and bioavailability. Second, it improves cellular uptake owing to the altered chemical properties of the prodrug, allowing efficient delivery across the plasma membrane. Once inside cells, endogenous enzymatic processes cleave the ProTide modifications, releasing the active monophosphate or triphosphate forms that interrupt essential nucleic acid transactions critical for cancer cell survival.

Even more revolutionary is the discovery that these cordycepin ProTide derivatives can preferentially target cancer stem cells (CSCs)—a subpopulation of cells responsible for tumor initiation, resistance, relapse, and metastasis. Cancer stem cells are notoriously difficult to eradicate with current therapies due to their unique biological properties and inherent drug resistance mechanisms.

**Potential Applications**

The applications for these compounds are both broad and profound, spanning:

1. **Haematological Malignancies**: Leukemia (e.g., acute lymphoblastic, myelogenous, chronic types), lymphoma (both Hodgkin and non-Hodgkin), multiple myeloma, and related disorders. The ability of these compounds to selectively target leukemic stem cells (LSCs) is supported by in vitro studies showing lower LD50 values and enhanced killing of the stem cell compartment.

2. **Solid Tumors**: Including, but not limited to, breast, lung, liver, head and neck, thyroid, neuroblastoma, melanoma, colon, pancreatic, and bladder cancers. The modification enables robust anti-tumor activity across solid tumor cell lines, as confirmed by comprehensive cytotoxicity assay data.

3. **Cancer Stem Cell Eradication**: The unique CSC-targeting property makes these compounds valuable for combating minimal residual disease, preventing relapse and metastasis. They hold promise both as first-line monotherapy and as adjuncts to other treatments (surgery, radiation, conventional chemotherapy).

4. **Pre-cancerous Conditions**: By targeting CSCs present in dysplastic and pre-malignant lesions (e.g., myelodysplastic syndrome), these compounds may serve prophylactic roles—potentially forestalling the progression to full-blown malignancy.

5. **Refractory and Relapsed Cancers**: The compounds are less susceptible to conventional resistance mechanisms, given their ability to generate cytotoxic nucleotide analogs even when nucleoside transport or kinase activities are downregulated, or ADA is overexpressed.

6. **Additional Therapeutic Areas**: The core molecule, cordycepin, is known for ancillary properties (anti-viral, anti-bacterial, anti-inflammatory, immunomodulatory, etc.), suggesting further offshoots in infectious disease and autoimmune disorder therapeutics.

**TAM/SAM Estimation for Lead Applications**

Let’s quantify the potential market size, starting with oncology—the lead domain:

1. **Total Addressable Market (TAM) – Global Oncology**:

According to recent reports (Global Cancer Drugs Market, Fortune Business Insights, 2024), the worldwide oncology drugs market was valued at approximately $188 billion in 2022 and is expected to exceed $250 billion by 2028, growing at a CAGR of 6-8%. Addressable cancers include most liquid (30-35% of market, led by leukemia and lymphoma) and solid tumors (remaining market).

2. **Serviceable Available Market (SAM) – Stem Cell-Targeted Therapies**:

Most current cancer therapeutics do not specifically address CSCs, though their role in resistance and relapse is well-documented. It is reasonable to estimate, based on tumor heterogeneity studies, that 20-30% of the oncology market would benefit from drugs that preferentially eliminate CSCs, particularly in relapsed/refractory disease, resulting in an approximate SAM of $50-75 billion globally.

3. **First Serviceable Obtainable Market (SOM) – Hematological Malignancies**:

The U.S. market for leukemia and related blood cancers alone is projected to be over $20 billion by 2026 (Market Data Forecast, 2024). Given the high relapse rates and unmet need for stem cell-targeting therapies, a conservative estimate is that 15-20% ($3-4 billion) of this is accessible for novel ProTide drugs—especially if proved superior to current nucleoside analogs and less toxic than ADA inhibitor combos.

4. **Niche Oncology Markets**:

– **Acute lymphoblastic leukemia (ALL)**: Global incidence is 60,000-70,000 cases/year (American Cancer Society, WHO Cancer Report 2023), generating several billion dollars in drug revenues (with stem cell therapies and advanced nucleoside analogs commanding premium reimbursement rates).

– **Refractory/relapsed cancers**: Roughly 15-20% of all oncology patients fall into this category at any given time, representing a high-value, high-need segment due to limited or no effective options.

**Why These Compounds Matter Now**

**1. Transforming the CSC Paradigm**

Traditional chemotherapy often shrinks tumor bulk but leaves behind resilient CSCs—hence, eventual relapse. The ability of these new cordycepin derivatives to preferentially reduce or eliminate CSCs—demonstrated in side-by-side in vitro comparisons—directly answers this clinical failure point.

**2. Superior Pharmacokinetics and Safety Profile**

The ProTide phosphoramidate approach not only boosts potency but also minimizes off-target toxicity. Unlike older generation drugs that require ADA inhibitors (with their attendant risks), these derivatives are stable in vivo and do not require adjunct pharmacologic protection. This improves patient tolerability, decreases the risk of adverse events, and streamlines dosing regimens.

**3. Resistance-Busting Capabilities**

Multi-drug resistance in cancer involves mechanisms such as impaired drug uptake, increased efflux, metabolic inactivation, or mutation of target enzymes. By bypassing key resistance nodes—demonstrated by maintenance of cytotoxic activity in the presence of ADA and nucleoside transport inhibitors—these derivatives offer hope where other drugs simply fail.

**4. Combination Therapy Synergy**

The compounds’ contribution isn’t limited to monotherapy. Data suggest additive or synergistic effects when combined with DNA-damaging agents (e.g., radiation), as cordycepin is known to inhibit repair of DNA strand breaks. This opens doors for rational combination regimens where CSCs and non-stem tumor bulk are targeted in tandem.

**5. Applicability Across Cancer Continuum**

Their broad mechanism of action—interference at the nucleoside triphosphate level—makes them useful from earliest precancerous lesions (to eradicate emerging CSCs and prevent cancer) to advanced metastatic or relapsed disease (to mop up CSCs that have survived previous interventions). This flexibility is unique among cancer drugs.

**Comparative Case: ProTide Technology in Drugs Like Sofosbuvir**

The ProTide strategy is proven in other therapeutic areas. For instance, the staggering success of sofosbuvir (Sovaldi®)—a hepatitis C ProTide—transformed chronic hepatitis C treatment and validated the prodrug approach for overcoming biological barriers and resistance. In oncology, the market is ripe for a similar game-changer.

**Clinical Development Path and Regulatory Outlook**

What is needed for transition from invention to commercial product? The scaffold is well-understood, and pilot in vitro and ex vivo data are robust. For these compounds, the next steps would be:

– **IND-enabling preclinical studies** in relevant animal models, focusing on pharmacokinetics, toxicity, and efficacy (especially for hematological cancers and solid tumor models with high CSC content).

– **Proof-of-concept clinical trials** in relapsed/refractory leukemias and lymphomas, with secondary expansion into pre-malignant syndromes like myelodysplastic syndrome (MDS) and solid tumors stratified for CSC markers.

– **Biomarker-driven patient selection**, exploiting the correlation between CSC marker positivity (e.g., CD34+, CD123+ for AML, CD44+ for solid tumors) and anticipated response to ProTide cordycepin therapy—a personalized medicine approach likely to appeal to regulators and payors.

– **Combination regimens** with standard-of-care (SOC) therapies and immune checkpoint inhibitors to probe for additive or synergistic effects.

The regulatory precedent set by existing nucleoside analogs streamlines this path; what’s new is the improved safety, pharmacology, and molecular targeting—factors which reduce trial risk and increase likelihood of FDA and EMA approval, particularly under expedited pathways for rare/refractory cancers.

**Broader Market Opportunities: Beyond Cancer**

While the focus is rightly on oncology, a nod must be given to ancillary applications. Cordycepin’s immunomodulatory, anti-infective, and anti-inflammatory properties suggest utility in diseases like viral hepatitis, certain autoimmune disorders, and potentially in anti-aging/lifespan extension markets—a rapidly growing TAM as global demographics shift.

**Competitive Landscape and IP Position**

Nucleoside analogs are a crowded field. However, proprietary phosphoramidate modifications and the demonstrated ability to bypass ADA inhibition stand as high intellectual property barriers. Moreover, these derivatives’ surprising capacity to home in on CSCs sets the technology apart from conventional cytotoxic chemotherapies or “brute-force” small molecules.

Given the winding down of patent life on legacy nucleoside drugs, life science companies are hungry for replacement blockbusters. Strategic partnerships, licensing, or acquisition of this technology is a logical avenue for big pharma and biotechs focused on differentiated cancer portfolios.

**Conclusion**

The invention of cordycepin ProTide derivatives marks a quantum advance in the war on cancer. By reengineering a natural product into a CSC-targeting, resistance-busting, and broadly applicable therapeutic, the inventors have laid the groundwork for new standards in cancer prevention, treatment, and remission maintenance.

Given the robust data for both cytotoxicity and stem cell specificity, the enormous unmet need in hematological malignancies and relapsed/refractory solid tumors, and a total addressable global oncology market exceeding $250 billion, these compounds are poised to become the backbone of next-generation chemotherapy.

Whether deployed as monotherapy for intractable leukemias, as adjuncts to radiation and immune therapies, or as prophylactics in high-risk pre-cancerous syndromes, the stage is set for these inventions to positively disrupt both the clinical standard of care and the economics of cancer treatment worldwide. As trials progress and more data emerge, investors, clinicians, and—most importantly—patients will be watching closely. Time may soon tell that the era of cordycepin ProTide-based cancer stem cell targeting has truly begun.

Click here and search US 20250163096 A1.